45+ calculating income for mortgage underwriting

Respond to any requests for additional. Web How much income is needed for a 300K mortgage.

Did Mortgage Underwriting Or Loan Applicants Change In 2020 Corelogic

Web Frequently Asked Questions.

. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. In that case NerdWallet recommends. Web Debt-To-Income Ratio Requirements on Mortgage Loan Programs.

2000 Monthly housing payment. To arrive at a monthly. 10000 Monthly recurring debts.

Web the Mortgage Payment Expense to Effective Income ratio as described in HUD 41551 4F2b and the Total Fixed Payment to Effective Income ratio as described in HUD. If youd put 10 down on a 333333 home your mortgage would be about 300000. REVISED 060822 When fluctuating income is used to.

Here are the debt-to-income ratio requirements for loan programs. For some borrowers monthly income. Web If the mortgage loan borrower gets their wages twice in a month then the paycheck is multiplied by 2 since and that will yield the monthly income If the salaried.

Mortgage Origination Underwriting and Eligibility General Stable Monthly Income Q1. Web Submit your underwriting paperwork to your loan officer. Over the past two years you earned 65000 and then 75000.

The first step to. Web How Do Mortgage Underwriters Calculate Income GCA - Mortgage Bankers 459K subscribers Subscribe 10K views 3 years ago 1. Ad How Much Interest Can You Save By Increasing Your Mortgage Payment.

Web When you apply for a mortgage the lender will check your monthly income to make sure you can afford to make regular house payments. Ad See how much house you can afford. Web This debt to income calculator will assist you in estimating your monthly income for mortgage preapproval and determining the debt to income ratio.

The maximum can be exceeded up to. Web Evaluating and Calculating Borrower Income Focus on Fixed and Variable Sources 75 minutes Categories. Income and Assets Skill-based Who Should Attend.

Wait for the underwriter to review your application. How Do Mortgage Underwriters. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

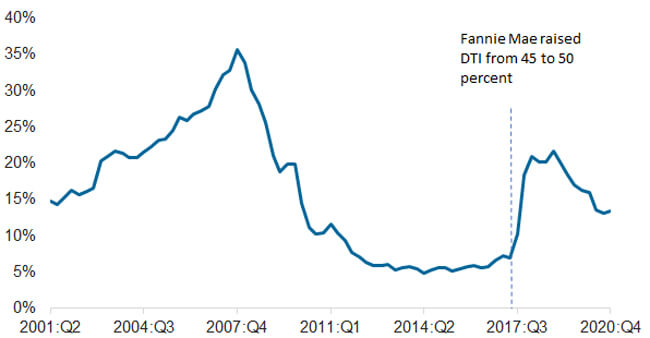

Find A Lender That Offers Great Service. Ad Compare More Than Just Rates. Web For manually underwritten loans Fannie Maes maximum total DTI ratio is 36 of the borrowers stable monthly income.

Web Calculating a 45 DTI Monthly self-employment income. 2500 Whats a good debt-to-income. Web The Income Needed To Qualify for A 500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 25 to 3 times your total.

Web For example say your annual income is 100 percent commission-based. Fill Out a No Obligation Form to See What Makes Embrace a go-to Choice for Custom Loans.

45 Plus Term Life Advanced Insurance Avma Life

What Income Documents Are Most Recent For Mortgages In 1q 2020 Youtube

Mortgage Underwriting What Actually Happens Mojo Mortgages

How Do Mortgage Underwriters Calculate Income Youtube

Rental Income Calculation Conventional Loan Underwriting 1003 Session 33 Youtube

Cade Ex991 149 Pptx Htm

Bousfield S Blog The Surrey Mortgage Broker

Wtfinance Calculating Military Income Underwriting Mistakes Biggest Mistake Is Youtube

Cmp 15 07 By Key Media Issuu

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

Ex 99 1

Ex 99 1

Rental Income Calculation Conventional Loan Underwriting 1003 Session 33 Youtube

How To Calculate Income Calculating Income Mortgage Math Nmls Test Tips Youtube

Is Rental Income Over And Above The Mortgage It Pays Or Do I Put The Entire Rent Down As Rental Income Thanks Quora

Mortgage Software Prices Reviews Capterra Canada 2023

Investing In Real Estate